Everyone knows how much hard work it takes to earn money. However, increasing money is an equally difficult task that is rarely discussed among the common people in India. Traditionally people here pay more attention to savings. Your money remains safe in savings but either it does not grow at all or grows at a very slow pace. Investment is necessary to grow money from money.

Compounding is a very important part of investing. Today we will tell you what is compounding which is so liked among investors. What is this magic wand that helps investors multiply their money? How is this feat achieved through final compounding?

What is compounding?

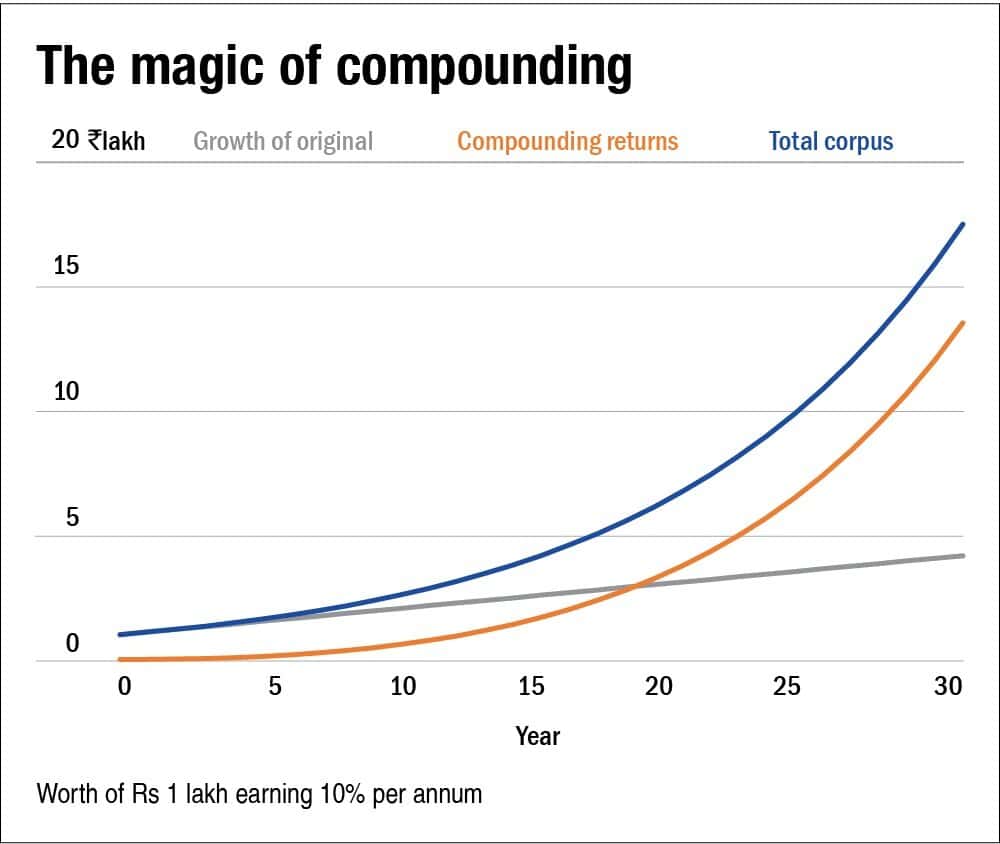

You must have heard of compound interest. You might have probably read about it in school. Even if you have not read it, know today. The interest earned on your money is called compound interest. Yes, no mistake has been made in writing the previous line. The interest received on interest is compound interest and this helps in increasing your money manifold. This is what is commonly called compounding.

Through the power of compounding, a small amount can grow into a substantial amount over some time. The longer the time frame, the higher the value. For example, to achieve your future financial goal, if you invest Rs 1 lakh per year in a bank fixed deposit for 30 years at a 5.5% interest rate (post-tax effective rate), your savings will be Rs 76.4 lakh. It will grow to Rs. 1000, which is two and a half times the amount you invested.

However, equities have historically outperformed other asset classes. They give an estimated profit of 16 percent in the long run. If you invest the same amount for the same period in equities instead of bank fixed deposits (assuming you get 14 percent interest), your savings will grow to Rs 4.1 crore. This value is thirteen and a half times more than the amount you invested.

Also, Read This: Understanding Credit Scores: What You Need to Know

Compounding works in the stock market also

Let us tell you that the concept of compounding works in the stock market too. Many companies allow investors to choose the option of DRIP. A dividend reinvestment plan allows an investor to reinvest the amount received from dividends in shares. Due to this, the number of shares held by the shareholder increases without investing any money and the future returns from it also increase.

How money grows through compounding

Suppose you invested Rs 10,000 every month in a SIP for 10 years. On this, you are getting 10 percent interest annually. You deposited a total of Rs 1.20 lakh in the first year. On this, you got 10 percent interest i.e. Rs 12,000. Now next year you again deposited Rs 1.20 lakh. But you will get interest not on Rs 2.40 lakh but on Rs 2.52 lakh. Similarly, your amount will keep increasing year after year. It is noteworthy that it helps in achieving tremendous returns in long-term investment. Even a one percent increase in returns can bring a huge jump in your compounding interest.

Some SIP Investment Plans and Calculations

SIP of Rs 10 thousand for 10 years

- Estimated return: 12 percent (annually)

- Investment period: 10 years

- Total investment: Rs 12 lakh

- The total value of SIP: Rs 23 lakh

- Benefit: Rs 11 lakh

- SIP investment of Rs 10 thousand for 15 years

- Estimated return: 12 percent per annum

- Investment period: 15 years

- Your total investment: Rs 18 lakh

- Total value of SIP: Rs 49.96 lakh

- Profit: Rs 31.96 lakh

SIP investment of Rs 10 thousand for 20 years

- Estimated return: 12 percent per annum

- Investment period: 20 years

- Your total investment: Rs 24 lakh

- Total value of SIP: Rs 98.93 lakh

- Profit: Rs 74.93 lakh

You can also make your own SIP plan as per your income by using the SIP Calculator.

Conclusion

Overall, Compounding is the hidden gem of financial growth, multiplying wealth steadily over time. Whether in savings, investments, or equities, harnessing the power of compounding can lead to substantial financial success.